The Tariff Effect

It’s hard to listen to the news without hearing the word, ‘tariff’. Since March 20181 tariffs have hit Canadian manufacturing industries hard. CBC (Canadian Broadcasting Corporation) started a show this fall called ‘Cost of Living’. The very first show focused on the sustained uncertainty and unpredictability tariffs have caused in our economy and their far-reaching impact on Canadians and Canadian manufacturing companies.2

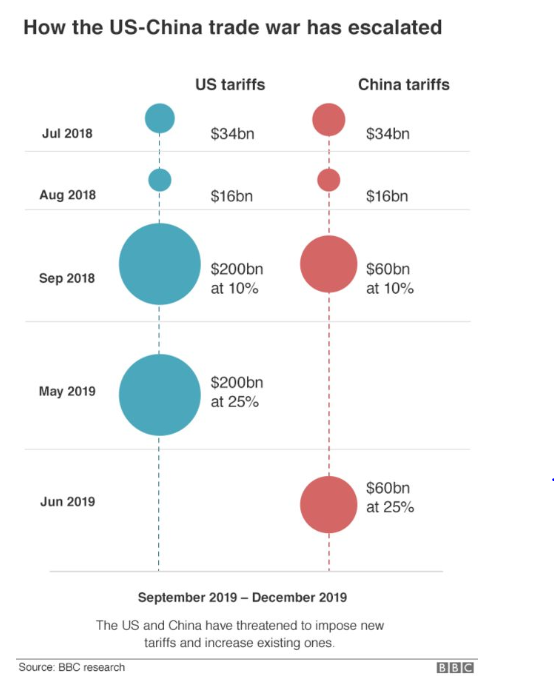

The recent 25%3 to 30% tariff4 on $50 billion worth of largely non-consumer goods entering the US, including machinery, electronic components and chemicals, has been challenging for Canadian OEM’s to fiscally absorb. BBC writes that these tariffs aren’t going away. In fact they are escalating.3B

So, what can Canadian OEM’s do to economically source components in the climate of increasing tariffs?

BAL (Baumen Associates Limited) customers and Principals have been creatively developing strategies to mitigate tariffs in order to retain the business partnerships and quality components that are the hallmarks of Canadian manufacturing. Some of the most effective strategies to emerge from this collaboration are bonded warehouses, plant relocation, identical plant production and establishing US certificates of origin.

Bonded Warehouses

Some of our global manufacturers (Principals) have established bonded warehouses in the United States where they already have head offices and distribution centres. The bonded warehouses work to eliminate the technical arrival of goods into the US and components thereby ship directly to Canada. Establishing a bonded warehouse5 is a time consuming and arduous process with strict government approvals. However, by establishing these bonded warehouses these Principals are able to bypass the tariffs for shipments bound to Canada and maintain their competitive pricing advantage in the Canadian market.

Plant Relocation and Identical Plant Production

Tariff pressures have caused other Principals to move their entire manufacturing plant from mainland China to Hong Kong in order to be tariff exempt to US customers. This move allows for imports to travel tariff free to the US and subsequently to Canadian OEM’s sourcing these components.

Other Principals with multiple manufacturing plants outside of China, have expanded their manufacturing capacity in these plants with the machinery to produce identical components globally that will be tariff exempt. All samples and components required by US customers and Canadian OEM’s ship directly from the non-China identical plant(s) for tariff free importing. The offset of this particular solution is that on occasion Canadian OEM’s have had to commit to larger shipping minimums due to container sizes and/or earlier forecasting of component requirements and temporary warehousing of surplus delivery. Sometimes, this has also meant compromises to spontaneity and rapid shifting of shipping amounts or minimums that once existed along our shared border.

Certificates of Origin

Finally, other Principals have seen the tariffs as an opportunity to once again manufacture components in the US as part of the Reshoring Initiative6 by optimizing their underutilized manufacturing space in existing plants. By manufacturing these components in the US versus Mexico or China, the US content of the components increases. Once the US content meets or exceeds 30% of the total value of the goods they qualify for a US certificate of origin, exempting these components from the 25% or more importing tariff.7

Tariffs costing us all

Tariffs are costing everyone in manufacturing. In August, New York Times wrote, “Now manufacturing is struggling amid a global slowdown and fallout from the trade war, which Mr. Trump has escalated by imposing additional tariffs on Chinese goods and by labeling China a “currency manipulator.”8

Canadian OEM’s can be assured, it seems, that global manufacturers are aware of the tariff impact on their Canadian partners. More importantly, the creative tariff mitigation strategies cited above suggest that Canadian OEM business and Canadian manufacturing are important enough to pay for. While there have been many thoughtful and creative solutions to offset the cost of tariffs, no one solution is without some expense. Mitigation strategies help Canadian OEM’s manage the increasing and unexpected penalty of tariffs. However, the unpredictable and ever-changing climate of tariffs makes for a manufacturing environment constantly in flux and constantly in need of new and innovative solutions to target the current tariff realities.

Curious about how Baumen could help you and your Canadian OEM mitigate tariffs? Call us today for a free consultation at 1-800-387-8172.

1- https://home.kpmg/xx/en/home/insights/2018/05/china-tax-alert-11.html

2- CBC – The Cost of Living – September 7, 2019: https://www.cbc.ca/listen/live-radio/1-379-cost-of-living/clip/15735002-sep.-7-2019-episode-1-low-simmering-anxiety-in-canadian-business-and-tiffs-surprising-superpower

3- https://home.kpmg/xx/en/home/insights/2018/05/china-tax-alert-11.html

3B- https://www.bbc.com/news/business-45899310

4- https://www.reuters.com/article/us-usa-trade-tariffs-factbox/factbox-next-rounds-of-trumps-tariffs-on-chinese-goods-to-hit-consumers-idUSKCN1VL0EX

5- https://customsnews.vn/6-conditions-to-be-approved-as-bonded-warehouses-389.html

6- http://www.reshorenow.org/

7- https://home.kpmg/xx/en/home/insights/2018/05/china-tax-alert-11.html

8- https://www.nytimes.com/2019/08/13/business/economy/donald-trump-jobs-created.html